About this book

Bitcoin Development Philosophy is a guide for new Bitcoin developers who already understand the basics of concepts and processes such as Proof-of-Work, block building, and the transaction life cycle, and who want to level up by gaining a deeper understanding of Bitcoin’s design trade-offs and philosophy. It should help new developers absorb the most important lessons of over a decade of Bitcoin development and discussion, and provide a context for evaluating new ideas (good ones and bad ones!).

Table of contents overview:

Your feedback and contributions are most welcome! Instructions for building and contributing can be found in Appendix B.

What to expect?

Bitcoin is a huge subject and we couldn’t possibly cover all of its aspects here. Nevertheless, we hope to discuss the necessary features to get you started as well as to enable you to further explore it on your own.

There are lots of people involved in Bitcoin; as some of them have opposing opinions, there are resources that express contradictory ideas. However, we always attempt to stick to the facts, where opinions do not matter.

Who wrote this?

The main author of this book is Kalle Rosenbaum, and Linnéa Rosenbaum contributed as a co-author. This work was commissioned and funded by Chaincode Labs, a development center that runs educational programs for developers who want to learn about Bitcoin development.

Kalle is the author of “Grokking Bitcoin” (Manning Publications) and is a seasoned software developer. He’s been working professionally with Bitcoin-related development since 2015.

Linnéa has a Ph.D. in Electronic Systems. She is the Swedish translator of “The Little Bitcoin Book” and co-translator of “The Bitcoin Standard”. She is also on the board of the Swedish Bitcoin Association. Her background is in firmware development with a recent shift towards software development.

How is this organized?

The book is sectioned into chapters covering different topics. Each chapter will guide you through a number of links to articles or videos that we recommend reading, and will briefly discuss each link. The reported material was written by individuals who have studied Bitcoin development for a long time.

The links refer to external resources on platforms we cannot

control. We have therefore saved the linked articles locally in this

repository, along with info on where it was copied from, and when. The

resources are collected in a separate

document (sources/sources.adoc) and organized by the chapter they are

linked from. The links found in the chapters refer to the original

sources, but if you don’t have an internet connection, the links

appear dead, or the content seems severely changed, you can read the

content locally instead.

1. Decentralization

This chapter analyzes what decentralization is and why it’s essential for Bitcoin to function. We distinguish between the decentralization of miners and that of full nodes, and discuss what they bring to the table for censorship resistance, one of Bitcoin’s most central properties. The discussion then shifts to understanding neutrality - or permissionlessness towards users, miners, and developers - which is a necessary property of any decentralized system. Lastly, we touch upon how hard it can be to grasp a decentralized system like Bitcoin, and present some mental models that might help you grok it.

A system without any central point of control is referred to as being decentralized. Bitcoin is designed to avoid having a central point of control, or more precisely a central point of censorship. Decentralization is a means to achieve censorship resistance.

There are two major aspects of decentralization in Bitcoin: miner decentralization and full node decentralization. Miner decentralization refers to the fact that transaction processing isn’t performed nor coordinated by any central entity. Full node decentralization refers to the fact that validation of the blocks, i.e. the data that miners output, gets done at the edge of the network, ultimately by its users, and not by a few trusted authorities.

1.1. Miner decentralization

There had been attempts at creating digital currencies before Bitcoin, but most of them failed due to a lack of governance decentralization and censorship resistance.

Miner decentralization in Bitcoin means that the ordering of transactions isn’t carried out by any single entity or fixed set of entities. It’s carried out collectively by all the actors who want to participate in it; this miners' collective is a dynamic set of users. Anyone can join or leave as they wish. This property makes Bitcoin censorship-resistant.

If Bitcoin were centralized, it would be vulnerable to those who wished to censor it, such as governments. It would meet the same fate as earlier attempts to create digital money. In the introduction of a paper titled “Enabling Blockchain Innovations with Pegged Sidechains”, the authors explain how early versions of digital money weren’t equipped for an adversarial environment:

David Chaum introduced digital cash as a research topic in 1983, in a setting with a central server that is trusted to prevent double-spending[Cha83]. To mitigate the privacy risk to individuals from this central trusted party, and to enforce fungibility, Chaum introduced the blind signature, which he used to provide a cryptographic means to prevent linking of the central server’s signatures (which represent coins), while still allowing the central server to perform double-spend prevention. The requirement for a central server became the Achilles’ heel of digital cash[Gri99]. While it is possible to distribute this single point of failure by replacing the central server’s signature with a threshold signature of several signers, it is important for auditability that the signers be distinct and identifiable. This still leaves the system vulnerable to failure, since each signer can fail, or be made to fail, one by one.

Enabling Blockchain Innovations with Pegged Sidechains (2014)

It became clear that using a central server to order transactions was not a viable option due to the high risk of censorship. Even if one replaced the central server with a federation of a fixed set of n servers, of which at least m must approve of an ordering, there would still be difficulties. The problem would indeed shift to one where users must agree on this set of n servers as well as on how to replace malicious servers with good ones without relying on a central authority.

Let’s contemplate what could happen if Bitcoin were censorable. The censor could pressure users to identify themselves, to declare where their money is coming from or what they’re buying with it before allowing their transactions to enter the blockchain.

Also, the lack of censorship resistance would allow the censor to coerce users into adopting new system rules. For example, they could impose a change that allowed them to inflate the money supply, thereby enriching themselves. In such an event, a user verifying blocks would have three options to handle the new rules:

-

Adopt: Accept the changes and adopt them into their full node.

-

Reject: Refuse to adopt the changes; this leaves the user with a system that doesn’t process transactions anymore, as the censor’s blocks are now deemed invalid by the user’s full node.

-

Move: Appoint a new central point of control; all of the users must figure out how to coordinate and then agree on the new central control point. If they succeed, the same issues will most likely resurface at some point in the future, considering that the system remained just as censorable as it was before.

None of these options are beneficial to the user.

Censorship resistance through decentralization is what separates Bitcoin from other money systems, but it is not an easy thing to accomplish due to the double-spending problem. This is the problem of making sure no one can spend the same coin twice, an issue that many people thought was impossible to solve in a decentralized fashion. Satoshi Nakamoto write in his Bitcoin whitepaper about how to solve the double-spending problem:

In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions.

Bitcoin: A Peer-to-Peer Electronic Cash System (2008)

Here he uses the peculiar-sounding phrase “peer-to-peer distributed timestamp server”. The keyword here is distributed, which in this context means that there is no central point of control. Nakamoto then goes on to explain how proof-of-work is the solution. Still, no one explains it better than Gregory Maxwell on Reddit, where he responds to someone who proposes to limit miners' hash power to avoid potential 51% attacks:

A decentralized system like Bitcoin uses a public election. But you can’t just have a vote of 'people' in a decentralized system because that would require a centralized party to authorize people to vote. Instead, Bitcoin uses a vote of computing power because it’s possible to verify computing power without the help of any centralized third party.

r/Bitcoin subreddit (2019)

The post explains how the decentralized Bitcoin network can come to an agreement on transaction ordering through the use of proof-of-work. He then concludes by saying that the 51% attack is not particularly worrisome, compared to people not caring about or not understanding Bitcoin’s decentralization properties.

A far bigger risk to Bitcoin is that the public using it won’t understand, won’t care, and won’t protect the decentralization properties that make it valuable over centralized alternatives in the first place.

r/Bitcoin subreddit (2019)

The conclusion is an important one. If people don’t protect Bitcoin’s decentralization, which is a proxy for its censorship resistance, Bitcoin might fall victim to centralizing powers, until it’s so centralized that censorship becomes a thing. Then most, if not all, of its value proposition is gone. This brings us to the next section on full node decentralization.

1.2. Full node decentralization

In the paragraphs above, we’ve mostly talked about miner decentralization and how centralizating miners can allow for censorship. But there’s also another aspect of decentralization, namely full node decentralization.

The importance of full node decentralization is related to trustlessness. Suppose a user stops running their own full node due to, for example, a prohibitive increase in the cost of operation. In that case, they have to interact with the Bitcoin network in some other way, possibly by using web wallets or lightweight wallets, which requires a certain level of trust in the providers of these services. The user goes from directly enforcing the network consensus rules to trusting that someone else will. Now suppose that most users delegate consensus enforcement to a trusted entity. In that case, the network can quickly spiral into centralization, and the network rules can be changed by conspiring malicious actors.

In a Bitcoin Magazine article, Aaron van Wirdum interviews Bitcoin developers about their views on decentralization and the risks involved in increasing Bitcoin’s maximum block size. This discussion was a hot topic during the 2014-2017 era, when many people argued over increasing the block size limit to allow for more transaction throughput.

A powerful argument against increasing the block size is that it increases the cost of verification (see the Scaling chapter). If verification cost rises, it will push some users to stop running their full nodes. This, in turn, will lead to more people not being able to use the system in a trustless way. Pieter Wuille is quoted in the article, where he explains the risks of full node centralization.

If lots companies run a full node, it means they all need to be convinced to implement a different rule set. In other words: the decentralization of block validation is what gives consensus rules their weight. But if full node count would drop very low, for instance because everyone uses the same web-wallets, exchanges and SPV or mobile wallets, regulation could become a reality. And if authorities can regulate the consensus rules, it means they can change anything that makes Bitcoin Bitcoin. Even the 21 million bitcoin limit.

The Decentralist Perspective or Why Bitcoin Might Need Small Blocks (2015)

There you go. Bitcoin users should run their own full nodes to deter regulators and big corporations from trying to change the consensus rules.

1.3. Neutrality

Bitcoin is neutral, or permissionless, as people like to call it. This means that Bitcoin doesn’t care who you are or what you use it for.

bitcoin is neutral, which is a good thing, and the only way it can work. if it was controlled by an organisation it’d just be another virtual object type and I would have zero interest in it

#bitcoin-core-dev 2012-04-04T17:34:04 UTC

As long as you play by the rules, you’re free to use it as you please, without asking anyone for permission. This includes mining, transacting in, and building protocols and services on top of Bitcoin.

-

If mining were a permissioned process, we would need a central authority to select who’s allowed to mine. This would most likely lead to miners having to sign legal contracts in which they would agree to censor transactions according to the whims of the central authority, which defeats the purpose of mining in the first place.

-

If people transacting in Bitcoin had to provide personal information, declare what their transactions were for, or otherwise prove that they were worthy of transacting, we would also need a central point of authority to approve users or transactions. Again, this would lead to censorship and exclusion.

-

If developers had to ask for permission to build protocols on top of Bitcoin, only the protocols allowed by the central developer granting committee would get developed. This would, due to government intervention, inevitably exclude all privacy-preserving protocols and all attempts at improving decentralization.

At all levels, trying to impose restrictions on who gets to use Bitcoin for what will hurt Bitcoin to the point where it’s no longer living up to its value proposition.

Pieter Wuille answers a question on Stack Exchange about how the blockchain relates to normal databases. He explains how permissionlessness is achievable through the use of proof-of-work in combination with economic incentives. He concludes:

Using trustless consensus algorithms like PoW does add something no other construction gives you (permissionless participation, meaning there is no set group of participants that can censor your changes), but comes at a high cost, and its economic assumptions make it pretty much only useful for systems that define their own cryptocurrency. There is probably only place in the world for one or a few actually used ones of these.

Stack Exchange (2019)

He explains that, in order to achieve permissionlessness, the system most likely needs its own currency, thereby “limiting the use cases to effectively just cryptocurrencies”. This is because permissionless participation, or mining, requires economic incentives built into the system itself.

1.4. Grokking decentralization

A compelling aspect of Bitcoin is how hard it is to grasp that no one controls it. There are no committees or executives in Bitcoin. Gregory Maxwell, again on the Bitcoin subreddit, compares this to the English language in an intriguing way:

Many people have a hard time understanding autonomous systems, there are many in their lives things like the english language-- but people just take them for granted and don’t even think of them as systems. They’re stuck in a centralized way of thinking where everything they think of as a 'thing' has an authority that controls it.

Bitcoin doesn’t focus on anything. Various people who have adopted Bitcoin chose of their own free will to promote it, and how they choose to do so is their own business. Authority fixated people may see these activities and believe they’re some operation by the bitcoin authority, but no such authority exists.

r/Bitcoin subreddit (2022)

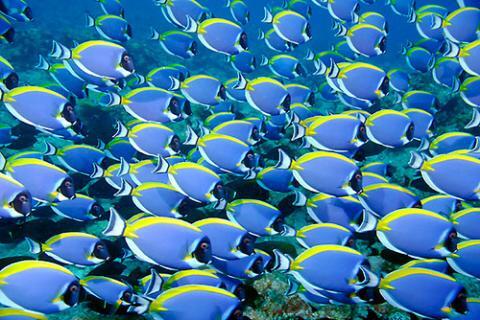

The way Bitcoin works through decentralization resembles the extraordinary collective intelligence found among many species in nature. Computer scientist Radhika Nagpal speaks in a Ted talk about the collective behavior of fish schools and how scientists are trying to mimic it using robots.

Secondly, and the thing that I still find most remarkable, is that we know that there are no leaders supervising this fish school. Instead, this incredible collective mind behavior is emerging purely from the interactions of one fish and another. Somehow, there are these interactions or rules of engagement between neighboring fish that make it all work out.

What intelligent machines can learn from a school of fish (2017)

She points out that many systems, either natural or artificial, can and do work without leaders, and they are powerful and resilient. Each individual only interacts with their immediate surroundings, but together they form something tremendous.

No matter what you think about Bitcoin, its decentralized nature makes it difficult to control. Bitcoin exists, and there’s nothing you can do about it. It’s something to be studied, not debated.

2. Trustlessness

This chapter dissects the concept of trustlessness, what it means from a computer science perspective, and why Bitcoin has to be trustless to retain its value proposition. We then talk about what it means to use Bitcoin in a trustless way, and what kind of guarantees a full node can and cannot give you. In the last section, we look at the real-world interaction between Bitcoin and actual softwares or users, and the need to make trade-offs between convenience and trustlessness to get anything done at all.

People often say things like "Bitcoin is great because it’s trustless". What do they mean by trustless? Pieter Wuille explains this widely used term on Stack Exchange:

The trust we’re talking about in "trustless" is an abstract technical term. A distributed system is called trustless when it does not require any trusted parties to function correctly.

Bitcoin Stack Exchange (2016)

In short, the word trustless refers to a property of the Bitcoin protocol whereby it can logically function without "any trusted parties". This is different from the trust you inevitably have to put into the software or hardware you run. More on this latter aspect of trust will be discussed further in this chapter.

In centralized systems, we rely on a central actor’s reputation in order to make sure that they will take care of security or roll back in case of issues, as well as on the legal system to sanction any violations. These trust requirements are problematic in pseudonymous decentralized systems - there is no possibility of recourse so there really can’t be any trust. In the introduction to the Bitcoin whitepaper, Satoshi Nakamoto describes this problem:

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for nonreversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party

Bitcoin: A Peer-to-Peer Electronic Cash System (2008)

It seems that we can’t have a decentralized system based on trust, and that’s why trustlessness is important in Bitcoin.

To use Bitcoin in a trustless manner, you have to run a fully-validating Bitcoin node. Only then will you be able to verify that the blocks you receive from others are following the consensus rules; for example, that the coin issuance schedule is kept and that no double-spends occur on the blockchain. If you don’t run a full node, you outsource verification of Bitcoin blocks to someone else and trust them to tell you the truth, which means you’re not using Bitcoin trustlessly.

David Harding has authored an article on the bitcoin.org website explaining how running a full node - or using Bitcoin trustlessly - actually helps you.

The bitcoin currency only works when people accept bitcoins in exchange for other valuable things. That means it’s the people accepting bitcoins who give it value and who get to decide how Bitcoin should work.

When you accept bitcoins, you have the power to enforce Bitcoin’s rules, such as preventing confiscation of any person’s bitcoins without access to that person’s private keys.

Unfortunately, many users outsource their enforcement power. This leaves Bitcoin’s decentralization in a weakened state where a handful of miners can collude with a handful of banks and free services to change Bitcoin’s rules for all those non-verifying users who outsourced their power.

Unlike other wallets, Bitcoin Core does enforce the rules—so if the miners and banks change the rules for their non-verifying users, those users will be unable to pay full validation Bitcoin Core users like you.

Full Validation on bitcoin.org (2015)

He says that running a full node will help you verify every aspect of the blockchain without trusting anyone else, so as to ensure that the coins you receive from others are genuine. This is great, but there’s one important thing that a full node can’t help you with: it can’t prevent double- spending through chain rewrites:

Note that although all programs—including Bitcoin Core—are vulnerable to chain rewrites, Bitcoin provides a defense mechanism: the more confirmations your transactions have, the safer you are. There is no known decentralized defense better than that.

Full Validation on bitcoin.org (2015)

No matter how advanced your software is, you still have to trust that the blocks containing your coins won’t be rewritten. However, as pointed out by Harding, you can await a number of confirmations, after which you consider the probability of a chain rewrite small enough to be acceptable.

The incentives for using Bitcoin in a trustless way align with the system’s need for full node decentralization. The more people who use their own full nodes, the more full node decentralization, and thus the stronger Bitcoin stands against malicious changes to the protocol. But unfortunately, as explained in the full node decentralization section, users often opt for trusted services as consequence of the inevitable trade-off between trustlessness and convenience.

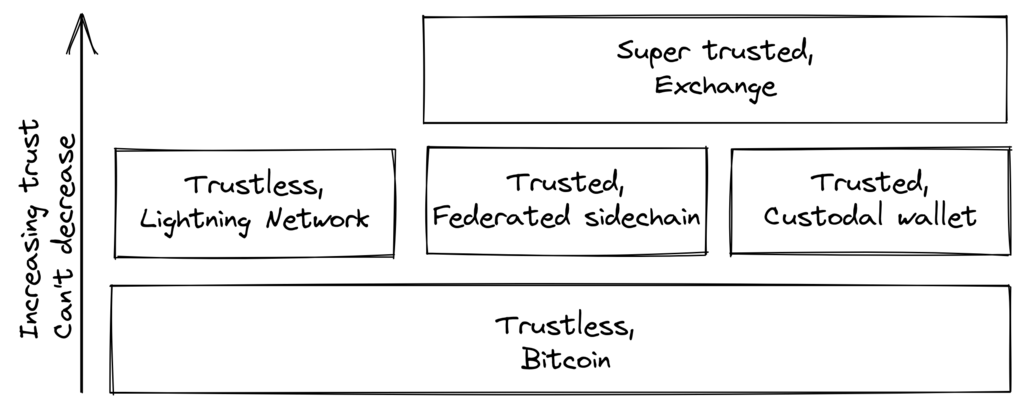

Bitcoin’s trustlessness is absolutely imperative from a system perspective. In 2018, Matt Corallo, spoke about trustlessness at the Baltic Honeybadger conference in Riga. The essence of that talk is that you can’t build trustless systems on top of a trusted system, but you can build trusted systems - for example, a custodial wallet - on top of a trustless system.

This security model allows the system designer to select trade-offs that make sense to them without forcing those trade-offs on others.

2.1. Don’t trust, verify

Bitcoin works trustlessly, but you still have to trust your software and hardware to some degree. That’s because your software or hardware might not be programmed to do what’s stated on the box. For example:

-

The CPU might be maliciously designed to detect private key cryptographic operations and leak the private key data.

-

The operating system’s random number generator might not be as random as it claims.

-

Bitcoin Core might have sneaked in code that will send your private keys to some bad actor.

So, besides running a full node, you also need to make sure you’re running what you intend to. Reddit user brianddk wrote an article about the various levels of trust you can choose from, when verifying your software. In the section "Trusting the builders", he talks about reproducible builds:

Reproducible builds are a way to design software so that many community developers can each build the software and ensure that the final installer built is identical to what other developers produce. With a very public, reproducible project like bitcoin, no single developer needs to be completely trusted. Many developers can all perform the build and attest that they produced the same file as the one the original builder digitally signed.

Bitcoin v22.0 and Guix; Stronger defense against the "Trusting Trust Attack" (2022)

The article defines 5 levels of trust: trusting the site, the builders, the compiler, the kernel, and the hardware.

To further deepen the topic of reproducible builds, Carl Dong made a presentation about Guix (video) explaining why trusting the operating system, libraries, and compilers can be problematic, and how to fix that with a system called Guix, which is used by Bitcoin Core today.

So what can we do about the fact that our toolchain can have a bunch of trusted binaries that can be reproducibly malicious? We need to be more than reproducible. We need to be bootstrappable. We cannot have that many binary tools that we need to download and trust from external servers controlled by other organizations. We should know how these tools are built and exactly how we can go through the process of building them again, preferably from a much smaller set of trusted binaries. We need to minimize our trusted set of binaries as much as possible, and have an easily auditable path from those toolchains to what we use how to build bitcoin. This allows us to maximize verification and minimize trust.

Breaking Bitcoin Conference (2019)

He then explains how Guix allows us to only trust a minimal binary of 357 bytes that can be verified and fully understood if you know how to interpret the instructions. This is quite remarkable: one verifies that the 357-byte binary does what it should, then uses it to build the full build system from source code, and ends up with a Bitcoin Core binary that should be an exact copy of anyone else’s build.

There’s a mantra that many bitcoiners subscribe to, which captures well much of the above:

Don’t trust, verify.

This alludes to the phrase "trust, but verify" that former U.S. president Ronald Reagan used in the context of nuclear disarmament. Bitcoiners switched it around to highlight the rejection of trust and the importance of running a full node.

It’s up to the users to decide to what degree they want to verify the software they use and the blockchain data they receive. As with so many other things in Bitcoin, there’s a trade-off between convenience and trustlessness. It’s almost always more convenient to use a custodial wallet compared to running Bitcoin Core on your own hardware. However, as Bitcoin software is maturing and user interfaces are improving, over time it should get better at supporting users willing to work towards trustlessness. Also, as users gain more knowledge over time, they should be able to gradually remove trust from the equation.

Some users think adversarially and verify most aspects of the software they run. As a consequence, they reduce the need for trust to the bare minimum, as they only need to trust their computer hardware and operating system. In doing so, they also help people who don’t verify their hardware as thoroughly by raising their voices in public to warn about any issues they might find. One good example of this is an event that occurred in 2018, when someone discovered a bug that would allow miners to spend an output twice in the same transaction:

CVE-2018-17144, a fix for which was released on September 18th in Bitcoin Core versions 0.16.3 and 0.17.0rc4, includes both a Denial of Service component and a critical inflation vulnerability. It was originally reported to several developers working on Bitcoin Core, as well as projects supporting other cryptocurrencies, including ABC and Unlimited on September 17th as a Denial of Service bug only, however we quickly determined that the issue was also an inflation vulnerability with the same root cause and fix.

Here, an anonymous person reported an issue that turned out much worse than the reporter realized. This highlights the fact that people who verify the code often report security flaws instead of exploiting them. This is beneficial to those who aren’t able to verify everything themselves. However, users should not trust others to keep them safe, but should rather verify for themselves whenever and whatever they can; that’s how one remains as sovereign as possible, and how Bitcoin prospers. The more eyes on the software, the less likely it is that malicious code and security flaws slip through.

3. Privacy

This chapter deals with how to keep your private financial information to yourself. It explains what privacy stands for in the context of Bitcoin, why it’s important, and what it means to say that Bitcoin is pseudonymous. It also looks into how private data can leak, both on-chain and off-chain. Then, it talks about the fact that bitcoins should be fungible, meaning interchangeable for any other bitcoins, and how fungibility and privacy go hand in hand. Lastly, the chapter introduces some measures you can take to improve your privacy and that of others.

Bitcoin can be described as a pseudonymous system (see Section 3.3 for further details on this), where users have multiple pseudonyms in the form of public keys. At first glance, this looks like a pretty good way to protect users from being identified, but it is in fact really easy to leak private financial information unintentionally.

3.1. What does privacy mean?

Privacy can mean different things in different contexts. In Bitcoin, it generally means that users don’t have to reveal their financial information to others, unless they voluntarily do so.

There are many ways in which you may leak your private information to others, with or without knowing it. Data can either leak from the public blockchain or through other means, for example when malicious actors intercept your internet communications.

3.2. Why is privacy important?

It may seem obvious why privacy is important in Bitcoin, but there are some aspects of it that one might not immediately think about. On the Bitcoin Talk forum, Gregory Maxwell walks us through a lot of good reasons why he thinks privacy matters. Among them are free market, safety, and human dignity:

Financial privacy is an essential criteria for the efficient operation of a free market: if you run a business, you cannot effectively set prices if your suppliers and customers can see all your transactions against your will. You cannot compete effectively if your competition is tracking your sales. Individually your informational leverage is lost in your private dealings if you don’t have privacy over your accounts: if you pay your landlord in Bitcoin without enough privacy in place, your landlord will see when you’ve received a pay raise and can hit you up for more rent.

Financial privacy is essential for personal safety: if thieves can see your spending, income, and holdings, they can use that information to target and exploit you. Without privacy malicious parties have more ability to steal your identity, snatch your large purchases off your doorstep, or impersonate businesses you transact with towards you… they can tell exactly how much to try to scam you for.

Financial privacy is essential for human dignity: no one wants the snotty barista at the coffee shop or their nosy neighbors commenting on their income or spending habits. No one wants their baby-crazy in-laws asking why they’re buying contraception (or sex toys). Your employer has no business knowing what church you donate to. Only in a perfectly enlightened discrimination free world where no one has undue authority over anyone else could we retain our dignity and make our lawful transactions freely without self-censorship if we don’t have privacy.

Bitcoin Talk forum (2013)

Maxwell also touches on fungibility, which will be discussed later in this chapter, as well as on how privacy and law enforcement are not contradictory.

3.3. Pseudonymity

We mentioned above that Bitcoin is pseudonymous, and that the pseudonyms are public keys. In the media you often hear that Bitcoin is anonymous, which is not correct. There is a distinction between anonymity and pseudonymity.

Andrew Poelstra explains in a Bitcoin Stack Exchange post what anonymity would look like in transactions:

Total anonymity, in the sense that when you spend money there is no trace of where it came from or where it’s going, is theoretically possible by using the cryptographic technique of zero-knowledge proofs.

Bitcoin Stack Exchange (2016)

The difference seems to be that in a pseudonymous form of money you can trace payments between pseudonyms, whereas in an anonymous form of money you can’t. Since bitcoin payments are traceable between pseudonyms, it’s not an anonymous system.

We have also said that the pseudonyms are public keys, but it’s actually addresses derived from public keys. Why do we use addresses as pseudonyms and not something else, for example some descriptive names, like “watchme1984”? This has been explained well by user Tim S., also on Bitcoin Stack Exchange:

In order for Bitcoin’s idea to work, you must have coins that can only be spent by the owner of a given private key. This means that whatever you send to must be tied, in some way, to a public key.

Using arbitrary pseudonyms (e.g. user names) would mean that you’d have to then somehow link the pseudonym to a public key in order to enable public/private key crypto. This would remove the ability to securely create addresses/pseudonyms offline (e.g. before someone could send money to the user name "tdumidu", you’d have to announce in the blockchain that "tdumidu" is owned by public key "a1c…", and include a fee so others have a reason to announce it), reduce anonymity (by encouraging you to reuse pseudonyms), and needlessly bloat the size of the blockchain. It would also create a false sense of security that you’re sending to who you think you are (if I take the name "Linus Torvalds" before he does, then it’s mine and people might send money thinking they’re paying the creator of Linux, not me).

Bitcoin Stack Exchange (2014)

By using addresses, or public keys, we achieve important goals, such as removing the need to somehow register a pseudonym beforehand, reducing the incentives for pseudonym reuse, avoiding blockchain bloat, and making it harder to impersonate other people.

3.4. Blockchain privacy

Blockchain privacy refers to the information you disclose by transacting on the blockchain. It applies to all transactions, the ones you send as well as the ones you receive.

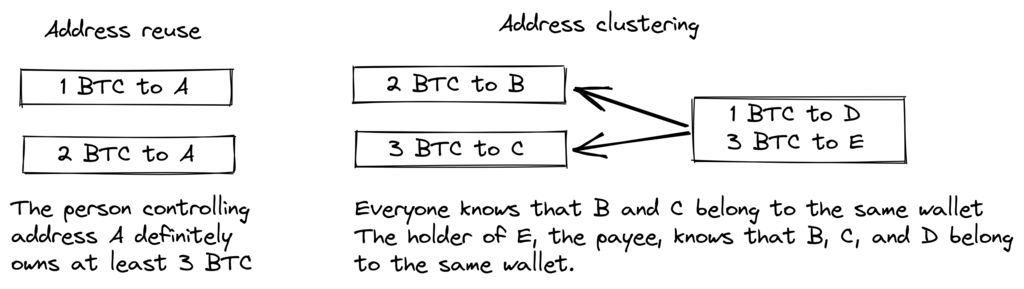

Satoshi Nakamoto ponders over on-chain privacy in section 7 of his Bitcoin whitepaper:

As an additional firewall, a new key pair should be used for each transaction to keep them from being linked to a common owner. Some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner. The risk is that if the owner of a key is revealed, linking could reveal other transactions that belonged to the same owner.

Bitcoin: A Peer-to-Peer Electronic Cash System (2008)

The paper summarizes the main problems of blockchain privacy, namely address reuse and address clustering. The first is self-explaining, the latter refers to the ability to decide, with some level of certainty, that a set of different addresses belongs to the same user.

Chris Belcher wrote in great detail about the different kinds of privacy leaks that can happen on the Bitcoin blockchain. We recommend you read at least the first few subsections under "Blockchain attacks on privacy."

The takeaway is that privacy in Bitcoin isn’t perfect. It requires a significant amount of work to transact privately. Most people aren’t prepared to go that far for privacy. There seems to be a clear trade-off between privacy and usability.

Another important aspect of privacy is that the measures you take to protect your own privacy affect other users as well. If you are sloppy with your own privacy, other people might experience reduced privacy, too. Gregory Maxwell explains this very plainly on the same Bitcoin Talk discussion that we linked above, and concludes with an example:

This actually works in practice, too… A nice whitehat hacker on IRC was playing around with brainwallet cracking and hit a phrase with ~250 BTC in it. We were able to identify the owner from just the address alone, because they’d been paid by a Bitcoin service that reused addresses and he was able to talk them into giving up the users contact information. He actually got the user on the phone, they were shocked and confused— but grateful to not be out their coin. A happy ending there. (This isn’t the only example of it, by far … but its one of the more fun ones).

Bitcoin Talk forum (2013)

In this case, it all went well thanks to the philanthropically-minded hacker, but don’t count on that next time.

3.5. Non-blockchain privacy

While the blockchain proves to be a notorious source of privacy leaks, there are plenty of other leaks that don’t use the blockchain, some sneakier than others. These range from key-loggers to network traffic analysis. To read up on some of these methods, please refer again to Chris Belcher’s piece, specifically the section "Non-blockchain attacks on privacy".

Among a plethora of attacks, Belcher mentions the possibility of someone snooping on your internet connection, for example, your ISP:

If the adversary sees a transaction or block coming out of your node which did not previously enter, then it can know with near-certainty that the transaction was made by you or the block was mined by you. As internet connections are involved, the adversary will be able to link the IP address with the discovered bitcoin information.

Bitcoin wiki

However, among the most obvious privacy leaks are exchanges. Due to laws, usually referred to as KYC (Know Your Customer) and AML (Anti-Money Laundering), that are valid in the jurisdictions they operate in, exchanges and related companies often have to collect personal data about their users, building up big databases about which users own which bitcoins. These databases are great honeypots for evil governments and criminals who are always on the lookout for new victims. There are actual markets for this kind of data, where hackers sell data to the highest bidder. To make things worse, the companies that manage these databases often have little experience with protecting financial data, in fact many of them are young start-ups, and we know for a fact that several leaks have already occurred. A few examples are India-based MobiQwik and HubSpot

Again, protecting data against this wide range of attacks is hard, and it is likely that you won’t be fully able to do so. You’ll have to opt for the trade-off between convenience and privacy that works best for you.

3.6. Fungibility

Fungibility, in the context of currencies, means that one coin is interchangeable for any other coin of the same currency. This funny word was briefly touched upon in Section 3.2. In the article discussed there, Gregory Maxwell stated

Financial privacy is an essential element to fungibility in Bitcoin: if you can meaningfully distinguish one coin from another, then their fungibility is weak. If our fungibility is too weak in practice, then we cannot be decentralized: if someone important announces a list of stolen coins they won’t accept coins derived from, you must carefully check coins you accept against that list and return the ones that fail. Everyone gets stuck checking blacklists issued by various authorities because in that world we’d all not like to get stuck with bad coins. This adds friction and transactional costs and makes Bitcoin less valuable as a money.

Bitcoin Talk forum (2013)

Here, he speaks about the dangers derived from a lack of fungibility. Suppose that you have a UTXO. That UTXO’s history can normally be traced back several hops, fanning out to multitudes of previous outputs. If any of those outputs were involved in any illegal, unwanted, or suspicious activity, then some potential recipients of your coin might reject it. If you think that your payees will verify your coins against some centralized whitelist or blacklist service, you might start checking the coins you receive too, just to be on the safe side. The result is that bad fungibility will bolster even worse fungibility.

Adam Back and Matt Corallo gave a presentation about fungibility at Scaling Bitcoin in Milan in 2016. They were thinking along the same lines:

You need fungibility for bitcoin to function. If you receive coins and can’t spend them, then you start to doubt whether you can spend them. If there are doubts about coins you receive, then people are going to go to taint services and check whether “are these coins blessed” and then people are going to refuse to trade. What this does is it transitions bitcoin from a decentralized permissionless system into a centralized permissioned system where you have an “IOU” from the blacklist providers.

Fungibility Overview (2016)

It seems that privacy and fungibility go hand-in-hand. Fungibility will weaken if privacy is weak, for example as coins from unwanted people may become blacklisted. In the same way, privacy will weaken if fungibility is weak: if there is a blacklist, you will have to ask the blacklist providers about which coins to accept, thereby possibly revealing your IP address, email address, and other sensitive information. These two features are so intertwined that it’s hard to talk about either of them in isolation.

3.7. Privacy measures

Several techniques have been developed to help people protecting themselves from privacy leaks. Among the most obvious ones is, as noted by Nakamoto above, using unique addresses for every transaction, but several others exist. We’re not going to teach you how to become a privacy ninja. However, Bitcoin Q+A has a quick summary of privacy-enhancing technologies, somewhat ordered by how hard they are to implement, at https://bitcoiner.guide/privacytips/. When you read it, you’ll notice that Bitcoin privacy often has to do with stuff outside of Bitcoin. For example, you shouldn’t brag about your bitcoins, and you should use Tor and VPN. The post also lists some measures directly related to Bitcoin:

- Full node

-

If you don’t use your own full node, you will leak lots of information about your wallet to servers on the internet. Running a full node is a great first step.

- Lightning Network

-

Several protocols exist on top of Bitcoin, for example the Lightning Network and Blockstream’s Liquid sidechain.

- CoinJoin

-

A way for multiple people to merge their transactions into one, making it harder to do chain analysis.

In a talk at the Breaking Bitcoin conference, Chris Belcher gave an interesting practical example of how privacy has been improved.

They were a bitcoin casino. Online gambling is not allowed in the US. Any customers of Coinbase that deposited straight to Bustabit would have their accounts shutdown because Coinbase was monitoring for this. Bustabit did a few things. They did something called change avoidance where you go through– and you see if you can construct a transaction that has no change output. This saves miner fees and also hinders analysis. Also, they imported their heavily-used reused deposit addresses into joinmarket. At this point, coinbase.com customers never got banned. It seems Coinbase’s surveillance service was unable to do the analysis after this, so it is possible to break these algorithms.

Breaking Bitcoin conference (2019)

He also mentioned this example, among others, on the Privacy page on the Bitcoin wiki.

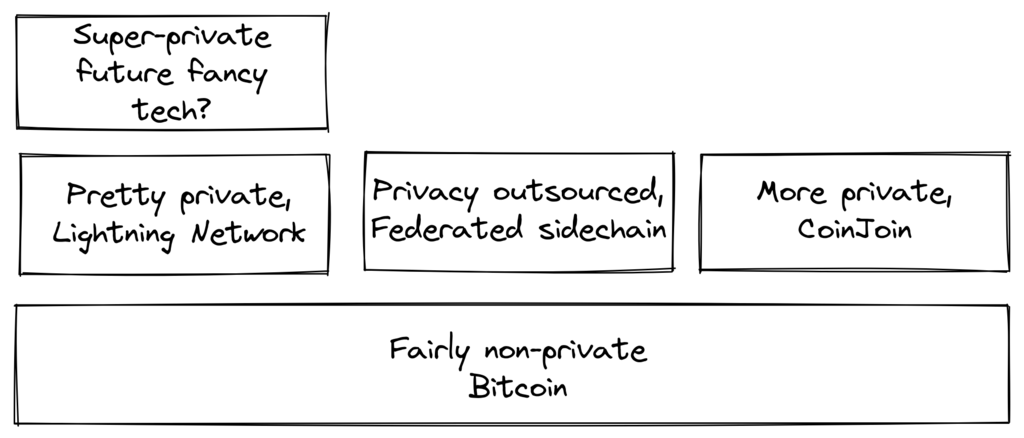

Note how better privacy can be achieved by building systems on top of Bitcoin, as is the case with Lightning Network:

We noted in Trustlessness that the need for trust can only increase with layers on top, but that doesn’t seem to be the case for privacy, which can be improved or made worse arbitrarily in layers on top. Why is that? Any layer on top of Bitcoin, as explained in Section 8.2.4, must use on-chain transactions occasionally, otherwise it wouldn’t be "on top of Bitcoin". Privacy-enhancing layers generally try to use the base layer as little as possible to minimize the amount of information revealed.

The above are somewhat technical ways to improve your privacy. But there are other ways. At the beginning of this chapter, we said that Bitcoin is a pseudonymous system. This means that users in Bitcoin aren’t known by their real names or other personal data, but by their public keys. A public key is a pseudonym for a user, and a user can have multiple pseudonyms. In an ideal world, your in-person identity is decoupled from your Bitcoin pseudonyms. Unfortunately, due to the privacy problems described in this chapter, this decoupling usually degrades over time.

To mitigate the risks of having your personal data revealed is to not give it out in the first place nor to give it to centralized services, which build big databases that can leak (see Section 3.5). An article by Bitcoin Q+A explains KYC and the dangers derived from it. It also suggests some steps you can take to improve your situation.

Thankfully there are some options out there to purchase Bitcoin via no KYC sources. These are all P2P (peer to peer) exchanges where you are trading directly with another individual and not a centralised third party. Unfortunately some sell other coins as well as bitcoin so we urge you to take care.

bitcoiner.guide

The article suggests you avoid using exchanges that require KYC/AML and instead trade in private, or use decentralized exchanges like bisq.

For more in-depth reading about countermeasures, refer to the previously mentioned wiki article on privacy, starting at "Methods for improving privacy (non-blockchain)".

4. Finite supply

This chapter looks into the bitcoin supply limit of 21 million BTC, or how much is it actually? We talk about how this limit is enforced and what one can do to verify that it’s being respected. Moreover, we take a peek into the crystal ball and discuss the dynamics that will come into play when the block reward shifts from subsidy-based to fee-based.

The well-known finite supply of 21 million BTC is regarded as a fundamental property of Bitcoin. But is it really set in stone?

Let’s start by looking at what the current consensus rules say about the supply of bitcoin, and how much of it will actually be usable. Pieter Wuille wrote a piece about this on Stack Exchange, in which he counted how many bitcoins there would be once all coins are mined:

If you sum all these numbers together, you get 20999999.9769 BTC.

Stack Exchange (2015)

But due to a number of reasons — such as early problems with coinbase transactions, miners who unintentionally claim less than allowed, and loss of private keys — that upper limit will never be reached. Wuille concludes:

This leaves us with 20999817.31308491 BTC (taking everything up to block 528333 into account)

... However, various wallets have been lost or stolen, transactions have been sent to the wrong address, people forgot they owned bitcoin. The totals of this may well be millions. People have tried to tally known losses up here.

This leaves us with: ??? BTC.

Stack Exchange (2015)

We can thus be sure that the bitcoin supply will be 20999817.31308491 BTC at most. Any lost or unverifiably burnt coins will make this number lower, but we don’t know by how much. The interesting thing is that it doesn’t really matter, or better yet it does matter in a positive way for bitcoin holders, as explained by Satoshi Nakamoto:

Lost coins only make everyone else’s coins worth slightly more. Think of it as a donation to everyone.

Bitcointalk forum (2010)

The finite supply will shrink and this should, at least in theory, cause price deflation.

More important than the exact number of coins in circulation is the way the supply limit is enforced without any central authority. Alias chytrik puts it well on Stack Exchange.

So the answer is that you don’t have to trust someone to not increase the supply. You just have to run some code that will verify that they haven’t.

Stack Exchange (2021)

Even if some full nodes turn to the dark side and decide to accept blocks with higher-value coinbase transactions, all the remaining full nodes will simply neglect them and continue doing business as usual. Some full nodes may, intentionally or unintentionally (see Section 9.2.2), run evil softwares, yet the collective will robustly secure the blockchain. In conclusion, you can choose to trust the system without having to trust anyone.

4.1. Block subsidy and transaction fees

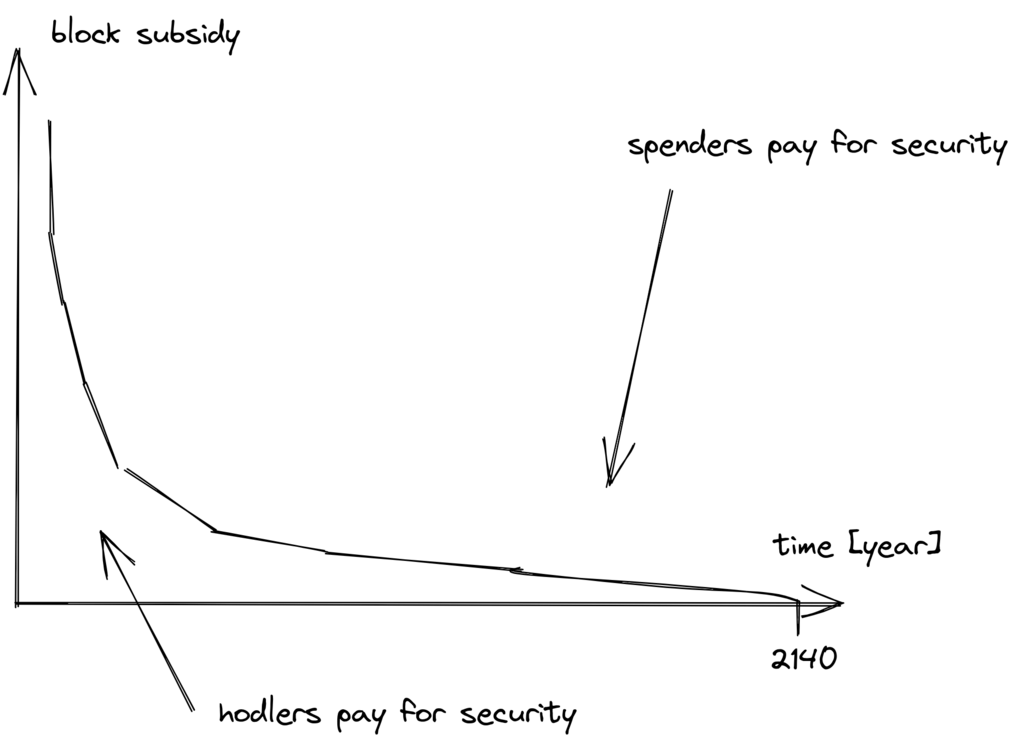

A block reward is composed of the block subsidy plus transaction fees. The block reward needs to cover Bitcoin’s security costs. We can say for sure that under today’s conditions with regard to block subsidy, transaction fees, bitcoin price, mempool size, hash power, degree of decentralization etc., the incentives for every player to play by the rules are high enough to preserve a secure monetary system.

What happens when the block subsidy approaches zero? To keep things simple, let’s assume it actually equals zero. At this point, the system’s security cost is covered through transaction fees only. What the future holds for us when this happens, we cannot know. The uncertainty factors are numerous and we are left to speculations. For example, Paul Sztorc’s contribution to the subject in his Truthcoin blog is mostly speculations, but he has at least one solid point (please note that M2, as referred to by Sztorc, is a measurement of a fiat money supply):

While the two are mixed into the same “security budget”, the block subsidy and txn-fees are utterly and completely different. They are as different from each other, as “VISA’s total profits in 2017” are from the “total increase in M2 in 2017”.

Truthcoin blog (2019)

Today, it is holders who pay for security (via monetary inflation). Tomorrow it will be the spenders' turn to somehow shoulder this burden, as illustrated below.

When transaction fees are the main motivation for mining, the incentives shift. Most notably, if the mempool of a miner doesn’t contain enough transaction fees, it might become more profitable for that miner to rewrite Bitcoin’s history rather than extending it. Bitcoin Optech has a specific section on this behavior, called fee sniping, written by David Harding:

Fee sniping is a problem that may occur as Bitcoin’s subsidy continues to diminish and transaction fees begin to dominate Bitcoin’s block rewards. If transaction fees are all that matter, then a miner with

xpercent of the hash rate has axpercent chance of mining the next block, so the expected value to them of honestly mining isxpercent of the best feerate set of transactions in their mempool.Alternatively, a miner could dishonestly attempt to re-mine the previous block plus a wholly new block to extend the chain. This behavior is referred to as fee sniping, and the dishonest miner’s chance of succeeding at it if every other miner is honest is

(x/(1-x))^2. Even though fee sniping has an overall lower probability of success than honest mining, attempting dishonest mining could be the more profitable choice if transactions in the previous block paid significantly higher feerates than the transactions currently in the mempool—a small chance at a large amount can be worth more than a large chance at a small amount.

Bitcoin Optech website

Throwing a wet blanket over our hopes for the future is the fact that if miners start conducting fee sniping, this will incentivize others to do the same, leaving even fewer honest miners. This could severely impair the overall security of Bitcoin. Harding goes on to list a few countermeasures that can be taken, such as relying on transaction time locks to restrict where in the blockchain the transaction may appear.

So, given that the consensus on finite supply remains, the block subsidy will - thanks to BIP42 which fixed a very-long-term inflation bug - get to zero around year 2140. Will the transaction fees thereafter be enough to secure the network? It’s impossible to say, but we do know a few things:

-

A century is a long time from the Bitcoin perspective. If it is still around, it will have probably evolved enormously.

-

If an overwhelming economic majority finds it necessary to change the rules and introduce for example a perpetual annual 0.1% or 1% monetary inflation, the supply of bitcoin will no longer be finite.

-

With zero block subsidy and an empty or nearly empty mempool, things can become shaky due to fee sniping.

Since the transition to a fee-only block reward is so far in the future, it might be wise not to jump to conclusions and try to fix the potential issues while we can. For example, Peter Todd thinks there’s an actual risk that Bitcoin’s security budget won’t be enough in the future, and consequently argues for a small perpetual inflation in Bitcoin. However, he also thinks it’s not a good idea to discuss such an issue at this time, as he said on the What Bitcoin Did podcast:

But, that’s a risk like 10, 20 years in the future. That is a very long time. And, by then, who the hell knows what the risks are?

What Bitcoin Did podcast (2019)

Perhaps we could think of Bitcoin as something organic. Imagine a small, slowly-growing oak plant. Imagine also that you have never seen a fully grown tree in your life. Wouldn’t it be wise then to restrain your control issues instead of setting in advance all the rules on how this plant should be allowed to evolve and grow?

5. Upgrading

Upgrading Bitcoin in a safe way can be extremely difficult. Some changes take several years to roll out. In this chapter, we learn about the common vocabulary around upgrading Bitcoin, and explore some examples of historic upgrades to its protocol as well as the insights that we gained from them. Finally, we talk about chain splits and the risks and costs related to them.

To get in tune for this chapter, you should read David Harding’s piece on harmony and discord.

Bitcoin experts talk often of consensus, whose meaning is abstract and hard to pin down. But the word consensus evolved from the Latin word concentus, "a singing together, harmony,"[1] so let us talk not of Bitcoin consensus but of Bitcoin harmony.

Harmony is what makes Bitcoin work. Thousands of full nodes each work independently to verify the transactions they receive are valid, producing a harmonious agreement about the state of the Bitcoin ledger without any node operator needing to trust anyone else. It’s similar to a chorus where each member sings the same song at the same time to produce something far more beautiful than any of them could produce alone.

The result of Bitcoin harmony is a system where bitcoins are safe not just from petty thieves (provided you keep your keys secure) but also from endless inflation, mass or targeted confiscation, or simply the bureaucratic morass that is the legacy financial system.

Harmony and Discord

This chapter discusses how Bitcoin can be upgraded without causing discord. Staying in harmony, i.e. maintaining consensus, is indeed one of the biggest challenges in Bitcoin development. There are lots of nuances to upgrade mechanisms, which might be best understood by studying actual cases of previous upgrades. For this reason, the chapter puts much focus on historic examples, and it starts by setting the stage with some useful vocabulary.

5.1. Vocabulary

According to Wikipedia, forward compatibility refers to the condition in which an old software can process data created by newer softwares, ignoring the parts it doesn’t understand.

A standard supports forward compatibility if a product that complies with earlier versions can "gracefully" process input designed for later versions of the standard, ignoring new parts which it does not understand.

Wikipedia

Vice versa, backward compatibility refers to when data from an old software is usable on newer softwares. A change is said to be fully compatible if it’s both forward and backward compatible.

A change to the Bitcoin consensus rules is said to be a soft fork if it is fully compatible. This is the most common way to upgrade Bitcoin, for a number of reasons that we’ll discuss further in this chapter. If a change to the Bitcoin consensus rules is backward compatible but not forward compatible, it is called a hard fork.

For a technical overview of soft forks and hard forks, please read chapter 11 of Grokking Bitcoin. It explains these terms and also dives into the upgrade mechanisms. It’s recommended, although not strictly necessary, to get a grip on this before you continue reading.

5.2. Historic upgrades

Bitcoin is not the same today as it was when the genesis block was created. Several upgrades have been made throughout the years. In 2017, Eric Lombrozo spoke at the Breaking Bitcoin conference (video) about Bitcoin’s different upgrading mechanisms, pointing out how much they have evolved over time. He even explained how Satoshi Nakamoto once upgraded Bitcoin through a hard fork.

There was actually a hard-fork in bitcoin that Satoshi did that we would never do it this way- it’s a pretty bad way to do it. If you look at the git commit description here [757f076], he says something about reverted makefile.unix wx-config version 0.3.6. Right. That’s all it says. It has no indication that it has a breaking change at all. He was basically hiding it in there. He also posted to bitcointalk and said, please upgrade to 0.3.6 ASAP. We fixed an implementation bug where it is possible that bogus transactions can be displayed as accepted. Do not accept bitcoin payments until you upgrade to 0.3.6. If you can’t upgrade right away, then it would be best to shutdown your bitcoin node until you do. And then on top of that, I don’t know why he decided to do this as well, he decided to add some optimizations in the same code. Fix a bug and add some optimizations.

Changing Consensus Rules Without Breaking Bitcoin at Breaking Bitcoin conference (2017)

He points out that, be it intentionally or not, this hard fork created opportunities for future soft forks, namely the Script operators (opcodes) OP_NOP1-OP_NOP10. We’ll look more into this code change in chapter 9. These opcodes have been used for two soft forks so far: BIP65 (OP_CHECKLOCKTIMEVERIFY), and BIP113 (OP_SEQUENCEVERIFY).

Lombrozo also provides an overview of the way upgrade mechanisms have evolved throughout the years, up until 2017. Since then, only one other major upgrade, which we analyze in Section 5.2.3, has been deployed. The long and somewhat chaotic process that led to its activation has helped us gain further insights on upgrading mechanisms in Bitcoin.

5.2.1. Segwit upgrade

While all the upgrades preceding Segwit had been more or less painless, this one was different. When Segwit activation code was released, in October 2016, there seemed to be overwhelming support for it among Bitcoin users, but for some reason miners didn’t signal support for this upgrade, which stalled the activation with no resolution in sight.

Aaron van Wirdum describes this winding road in his Bitcoin Magazine article The Long Road To Segwit. He starts by explaining what Segwit is and how that taps into the block size debate. Van Wirdum then outlines the turn of events that led to its final activation. At the center of this process was an upgrade mechanism called user activated soft fork, or UASF for short, that was proposed by user Shaolinfry.

Shaolinfry proposed an alternative: a user activated soft fork (UASF). Instead of hash power activation, a user activated soft fork would have a “‘flag day activation’ where nodes begin enforcement at a predetermined time in the future.” As long as such a UASF is enforced by an economic majority, this should compel a majority of miners to follow (or activate) the soft fork.

The Long Road To Segwit on Bitcoin Magazine (2017)

Among other things, he cites Shaolinfry’s email to the Bitcoin-dev mailing list. In that occasion Shaolinfry argued against miner activated soft forks, listing a number of problems with them.

Firstly, it requires trusting the hash power will validate after activation. The BIP66 soft fork was a case where 95% of the hashrate was signaling readiness but in reality about half was not actually validating the upgraded rules and mined upon an invalid block by mistake[1].

Secondly, miner signalling has a natural veto which allows a small percentage of hashrate to veto node activation of the upgrade for everyone. To date, soft forks have taken advantage of the relatively centralised mining landscape where there are relatively few mining pools building valid blocks; as we move towards more hashrate decentralization, it’s likely that we will suffer more and more from "upgrade inertia" which will veto most upgrades.

Bitcoin-dev mailing list (2017)

Shaolinfry also drew attention to a common misinterpretation of miner signaling: people generally thought that it was a means by which miners could decide upon protocol upgrades, rather than an action that helped coordinate upgrades. Due to this misunderstanding, miners might have also felt obliged to proclaim in public their views on a certain soft fork, as if that gave weight to the proposal.

The UASF proposal is, in a nutshell, a "flag day" on which nodes start enforcing specific new rules. That way, miners don’t have to make a collective effort to coordinate the upgrade, and can even trigger activation earlier than the flag day if enough blocks signal support.

My suggestion is to have the best of both worlds. Since a user activated soft fork needs a relatively long lead time before activation, we can combine with BIP9 to give the option of a faster hash power coordinated activation or activation by flag day, whichever is the sooner. In both cases, we can leverage the warning systems in BIP9. The change is relatively simple, adding an activation-time parameter which will transition the BIP9 state to LOCKED_IN before the end of the BIP9 deployment timeout.

Bitcoin-dev mailing list (2017)

This idea caught a lot of interest, but didn’t seem to reach near unanimous support, which caused concern for a potential chain split. The article by Aaron van Wirdum explains how this finally got resolved thanks to BIP91, authored by James Hilliard.

Hilliard proposed a slightly complex but clever solution that would make everything compatible: Segregated Witness activation as proposed by the Bitcoin Core development team, the BIP148 UASF and the New York Agreement activation mechanism. His BIP91 could keep Bitcoin whole — at least throughout SegWit activation.

The Long Road To Segwit on Bitcoin Magazine (2017)

There were some more complicating factors involved (e.g. the so-called "New York Agreement"), that this BIP had to take into consideration. We encourage you to read Van Wirdum’s article in full to learn about the many interesting details in this story.

5.2.2. Post-Segwit discussion

After the Segwit deployment, a discussion about deployment mechanisms emerged. As noted by Eric Lombrozo in his talk at the Breaking Bitcoin conference (video) and by Shaolinfry (see Section 5.2.1 above), a miner activated soft fork isn’t the ideal upgrade mechanism.

At some point we’re probably going to want to add more features to the bitcoin protocol. This is a big philosophical question we’re asking ourselves. Do we do a UASF for the next one? What about a hybrid approach? Miner activated by itself has been ruled out. bip9 we’re not going to use again.

Changing Consensus Rules Without Breaking Bitcoin at Breaking Bitcoin conference (2017)

In January 2020, Matt Corallo sent an email to the Bitcoin-dev mailing list that started a discussion on future soft fork deployment mechanisms. He listed five goals that he thought were essential in an upgrade. David Harding summarizes them in a Bitcoin Optech newsletter as:

The ability to abort if a serious objection to the proposed consensus rules changes is encountered

The allocation of enough time after the release of updated software to ensure that most economic nodes are upgraded to enforce those rules

The expectation that the network hash rate will be roughly the same before and after the change, as well as during any transition

The prevention, as much as possible, of the creation of blocks that are invalid under the new rules, which could lead to false confirmations in non-upgraded nodes and SPV clients

The assurance that the abort mechanisms can’t be misused by griefers or partisans to withhold a widely desired upgrade with no known problems

Bitcoin Optech newsletter #80 (2020)

What Corallo proposes is a combination of a miner activated soft fork and a user activated soft fork:

Thus, as something a bit more concrete, I think an activation method which sets the right precedent and appropriately considers the above goals, would be:

1) a standard BIP 9 deployment with a one-year time horizon for activation with 95% miner readiness,

2) in the case that no activation occurs within a year, a six month quieting period during which the community can analyze and discussion the reasons for no activation and,

3) in the case that it makes sense, a simple command-line/bitcoin.conf parameter which was supported since the original deployment release would enable users to opt into a BIP 8 deployment with a 24-month time-horizon for flag-day activation (as well as a new Bitcoin Core release enabling the flag universally).This provides a very long time horizon for more standard activation, while still ensuring the goals in #5 are met, even if, in those cases, the time horizon needs to be significantly extended to meet the goals of #3. Developing Bitcoin is not a race. If we have to, waiting 42 months ensures we’re not setting a negative precedent that we’ll come to regret as Bitcoin continues to grow.

Modern Soft Fork Activation on Bitcoin-dev mailing list (2020)

5.2.3. Taproot upgrade - Speedy Trial

When Taproot was ready for deployment [comm: add time coordinates], meaning all the technical details around its consensus rules had been implemented and had reached broad approval within the community, discussions on how to actually deploy it started to heat up. These discussions had been pretty low key up until that point.

Lots of proposals for activation mechanisms started floating around, and David Harding summarized them on the Bitcoin Wiki. In his article he explained some properties of BIP8, which at that time had some recent changes made in order to make it more flexible.

At the time this document is being written, BIP8 has been drafted based on lessons learned in 2017. One notable change following BIPs 9+148 is that forced activation is now based on block height rather than median time past; a second notable change is that forced activation is a boolean parameter chosen when a soft fork’s activation parameters are set either for the initial deployment or updated in a later deployment.

BIP8 without forced activation is very similar to BIP9 version bits with timeout and delay, with the only significant difference being BIP8’s use of block heights compared to BIP9’s use of median time past. This setting allows the attempt to fail (but it can be retried later).

BIP8 with forced activation concludes with a mandatory signaling period where all blocks produced in compliance with its rules must signal readiness for the soft fork in a way that will trigger activation in an earlier deployment of the same soft fork with non-mandatory activation. In other words, if node version x is released without forced activation and, later, version y is released that successfully forces miners to begin signaling readiness within the same time period, both versions will begin enforcing the new consensus rules at the same time.

This flexibility of the revised BIP8 proposal makes it possible to express some other ideas in terms of what they would look like using BIP8. This provides a common factor to use for categorizing many different proposals.

From this point forward the discussions became very heated, especially

around whether lockinontimeout should be true (as in a user

activated soft fork, referred to as “BIP8 with forced activation” by

Harding) or false (as in a miner activated soft fork, referred to as

“BIP8 without forced activation” by Harding).

Among the proposals listed, one of them was titled “Let’s see what happens”. For some reason, this proposal didn’t get much traction until seven months later.

During those seven months, the discussion went on and it seemed like

there was no way to reach broad consensus over which deployment

mechanism to use. There were mainly two camps: one that preferred

lockinontimeout=true (the UASF crowd) and the other one that preferred

lockinontimeout=false (the “try and if it fails rethink” crowd). Since

there was no overwhelming support for any of these options, the

debate went in circles with seemingly no way forward. Some of

these discussions were held on IRC, in a channel called

##taproot-activation, but

on March 5th 2021,

something changed:

06:42 < harding> roconnor: is somebody proposing BIP8(3m, false)? I mentioned that the other day but I didn't see any responses. [...] 06:43 < willcl_ark_> Amusingly, I was just thinking to myself that, vs this, the SegWit activation was actually pretty straightforward: simply a LOT=false and if it fails a UASF. 06:43 < maybehuman> it's funny, "let's see what happens" (i.e. false, 3m) was a poular choice right at the beginning of this channel iirc 06:44 < roconnor> harding: I think I am. I don't know how much that is worth. Mostly I think it would be a widely acceptable configuration based on my understanding of everyone's concerns. 06:44 < willcl_ark_> maybehuman: becuase everybody actually wants this, even miners reckoned they could upgrade in about two weeks (or at least f2pool said that) 06:44 < roconnor> harding: BIP8(3m,false) with an extended lockin-period. 06:45 < harding> roconnor: oh, good. It's been my favorite option since I first summarized the options on the wiki like seven months ago. 06:45 <@michaelfolkson> UASF wouldn't release (true,3m) but yeah Core could release (false, 3m) 06:45 < willcl_ark_> harding: It certainly seems like a good approach to me. _if_ that fails, then you can try an understand why, without wasting too much time

The “let’s see what happens” approach finally seemed to click in peoples' minds. This process would later be labeled as “Speedy Trial” due to its short signaling period. David Harding explains this idea to the broader community in an email to the Bitcoin-dev mailing list.

The earlier version of this proposal was documented over 200 days ago[3] and taproot’s underlying code was merged into Bitcoin Core over 140 days ago.[4] If we had started Speedy Trial at the time taproot was merged (which is a bit unrealistic), we would’ve either be less than two months away from having taproot or we would have moved on to the next activation attempt over a month ago.

Instead, we’ve debated at length and don’t appear to be any closer to what I think is a widely acceptable solution than when the mailing list began discussing post-segwit activation schemes over a year ago.[5] I think Speedy Trial is a way to generate fast progress that will either end the debate (for now, if activation is successful) or give us some actual data upon which to base future taproot activation proposals.

This deployment mechanism was refined over the course of two months

and then released in

Bitcoin

Core version 0.21.1. The miners quickly started signaling for this

upgrade moving the deployment state to LOCKED_IN, and after a grace

period the Taproot rules were activated mid-November 2021 in block

709632.

5.2.4. Future deployment mechanisms

Given the problems with the recent soft forks, Segwit and Taproot, it’s not clear how the next upgrade will be deployed. Speedy Trial was used to deploy Taproot, but it was used to bridge the chasm between the UASF and the MASF crowds, not because it has emerged as the best known deployment mechanism.

5.3. Risks

During the activation of any fork, be it hard or soft, miner activated or user activated, there’s the risk of a long-lasting chain split. A split that lingers for more than a few blocks can cause severe damage to the sentiment around Bitcoin as well as to its price. But above all, it would cause great confusion over what Bitcoin is. Is Bitcoin this chain or that chain?

The risk with a user activated soft fork is that the new rules get activated even if the majority of the hash power doesn’t support them. This scenario would result in a long-lasting chain split, which would persist until the majority of the hash power adopts the new rules. It could be especially hard to incentivize miners to switch to the new chain if they had already mined blocks after the split on the old chain, because by switching branch they would be abandoning their own block rewards. However, it’s worth mentioning a remarkable episode: in March 2013 a long-lasting split, explained in Section 9.2.3, occurred due to an unintentional hard fork and, contrary to this incentive, two major mining pools made the decision to abandon their branch of the split in order to restore consensus.

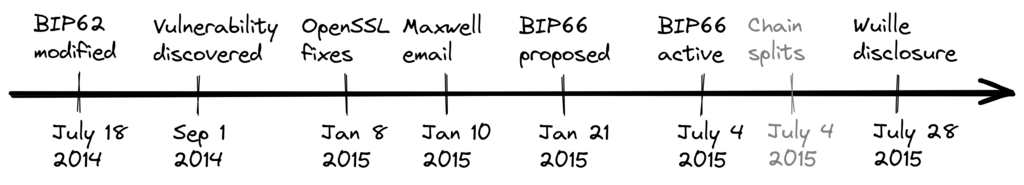

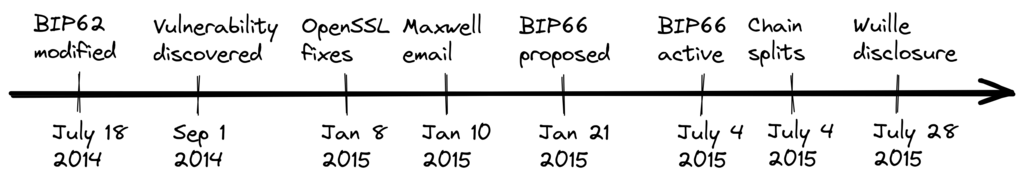

On the other hand, the risk with a miner activated soft fork is a consequence of the fact that miners can engage in false signaling, which means that the actual share of the hash power that supports the change could be smaller than it looks. If the actual support doesn’t comprise a majority of the hash power, we’d probably see a long-lasting chain split similar to the one described in the previous paragraph. This, or at least a similar issue, has happened in reality when BIP66 was deployed (see Section 9.2.4), but it got resolved within 6 blocks or so.

5.3.1. Costs of a split

Jimmy Song spoke about the costs associated with hard forks at Breaking Bitcoin in Paris, but much of what he said applies to a chain split due to a failed soft fork as well. He spoke about negative externalities, and defined them as the price someone else has to pay for your own actions.

The classic example of a negative externality is a factory. Maybe they are producing– maybe it’s an oil refinery and they produce a good that is good for the economy but they also produce something that is a negative externality, like pollution. It’s not just something that everyone has to pay for, to clean up, or suffer from. But it’s also 2nd and 3rd order effects, like more traffic going towards the factory as a result of more workers that need to go there. You might also have- you might endanger some wildlife around there. It’s not that everyone has to pay for the negative externalities, it might be specific people, like people who were previously using that road or animals that were near that factory, and they are also paying for the cost of that factory.

Socialized Costs Of Hard Forks at Breaking Bitcoin conference (2017)

In the context of Bitcoin, he exemplifies negative externalities using Bitcoin Cash (bcash), which is a hard fork of Bitcoin created shortly prior to that conference in 2017. He categorizes the negative externalities of a hard fork into one-time costs and permanent costs.

Among the many examples of one-time costs, he mentions the ones incurred by exchanges.

So we have a bunch of exchanges and they had a lot of one-time costs that they had to pay. The first thing that happened is that deposits and withdrawals had to be halted for a day or two for these exchanges because they didn’t know what would happen. Many of these exchanges had to dip into cold storage because their users were demanding bcash. It’s part of their fidicuiary duty, they have to do that. You also have to audit the new software. This is something that we had to do at itbit. We want to spend bcash- how do we do it? We have to download electron cash? Does it have malware? We have to go and audit it. We had like 10 days to figure out if this was okay or not. And then you have to decide, are we going to just allow a one-time withdrawal, or are we going to list this new coin? For an exchange to lis ta new coin, it’s not easy- there’s all sorts of new procedures for cold storage, signing, deposits, withdrawals. Or you could just have this one-off event where you give them their bcash at some point and then you never think about it again. But that has its problems too. And finally, and whatever way you do it, withdrawals or listing– you are going to need new infrastructure to work with this token in some way, even if it’s a one-time withdrawal. You need some way to give these tokens to your users. Again, short-notice. Right? No time to do this, has to be done quickly.

Socialized Costs Of Hard Forks at Breaking Bitcoin conference (2017)

He also lists the one-time costs incurred by merchants, payment processors, wallets, miners, and users, as well as some of the permanent costs, for example privacy loss and a higher risk of reorgs.